The Federal Reserve has announced that it will soon hike rates, but likely not in March. As a rule of thumb, the Fed hikes rates when it wants to control inflation, and decreases them when it wants to stimulate the economy and lower unemployment.

The higher rates have been very rare since 2008, when they were dropped close to 0% to fight the recession. Rising unemployment since January could be a sign of a coming recession or austerity. Cheap money could stop this trend with greater consumption, but this in turn could make inflation larger. CNN says:

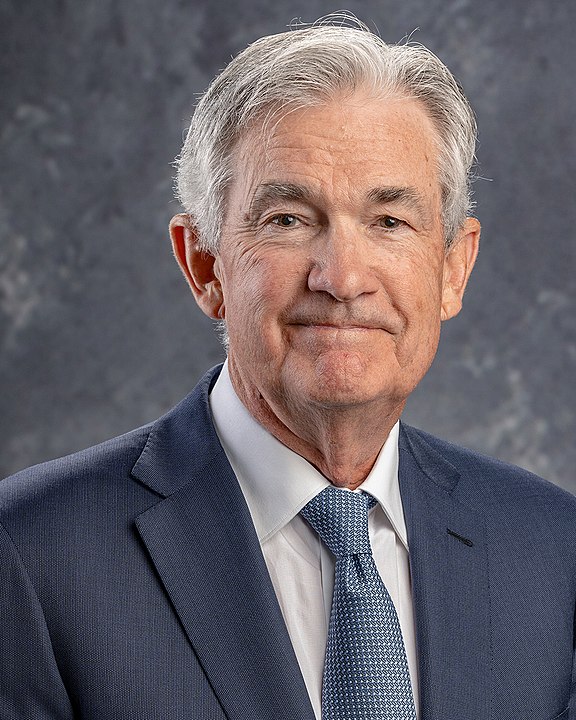

Federal Reserve Chair Jerome Powell said the time is coming for interest rate cuts, but asked Americans for a bit more patience in the central bank’s fight against inflation.

The US economy is strong and the central bank will likely lower later interest rates later this year, he said, but it’s just “not likely” to happen this March, as Wall Street once expected it to.

Savings accounts and certificates of deposits have been paying over 4%, also relatively rare since 2008. A cut in rates would push Americans towards consuming, and hurt older Americans who rely on fixed income returns like bonds. The NY Times continues:

The S&P 500 fell 1.6 percent on Wednesday, with a decline fueled by Mr. Powell’s comments during the news conference, after he said, “I don’t think it’s likely” that the Fed will cut rates in March.

Expectations of rate cuts have waxed and waned over the past several months. So has the behavior of the stock market. After the Fed’s previous meeting in December, in which it signaled that rate cuts were likely sometime in 2024, the futures market began to count on the start of those rate cuts being at the Fed’s next meeting, in March.

A drop in rates would make home buying more affordable, enabling more seniors to sell their homes and young families to buy theirs. Being aware of these changes can give Americans a chance to know when and what to buy, whether fixed income securities or real estate, to best hedge against inflation.

READ NEXT: Judge Goes After Elon Musk